If you’re looking for some easy ways to save $1,000 fast, keep reading, plus grab the free emergency fund tracker printable and worksheet.

Dave Ramsey’s baby Step 1 is to save $1,000, for your starter emergency fund. Once you are debt free, you’ll want to build that emergency fund up to 3 to 6 months of living expenses.

When we first started baby step 1 of Dave Ramsey’s 7 baby steps, we kind of brushed over this important little step! We were much more concerned about tackling our debt in baby step 2.

Baby step 1 is important for several reasons. Maybe you’ve never been able to save money in your life, or you’re just now learning how to budget with your spouse.

Saving that first $1000 is so satisfying and motivating.

Related: Dave Ramsey’s Baby Steps for Six Figure Debt.

The vast majority of Americans live paycheck to paycheck and are unable to cover a $1,000 emergency. It’s important to take the time to build up that $1,000 emergency fund, and do it fast!

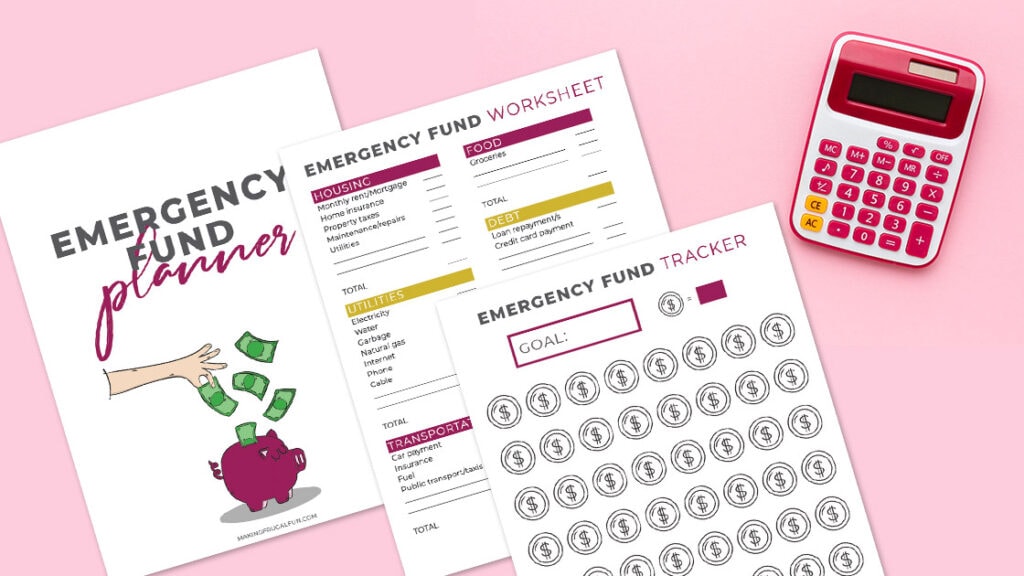

Grab this free Emergency Fund worksheet and printable tracker and get started!

Here are 7 ways to complete Dave Ramsey’s Baby Step 1 fast!

Nail down the Budget.

- The best way to find $1,000 is honestly to use the income you already have!

- If you are just starting Dave Ramsey’s Baby Steps, you might not be an expert at sticking to a budget.

- Learning to budget, and “telling your money where to go”, are the best ways to feel like you instantly got a raise!

- You might be able to cash flow your $1,000 baby step 1 in your first 30-90 days, just by being more intentional.

Related: How to Make a Budget, How to Budget with Your Spouse

Have a garage sale.

- You probably have way more stuff than you actually need in your home.

- Look around and see what you have that you could sell for cash!

- We were able to make $1700 at our garage sale this year which helped us complete Dave Ramsey’s baby step 1, and fund some moving expenses.

Related: How to Have a Successful Garage Sale

Cut Your Expenses.

- Look at your current spending habits and analyze them.

- Are you spending too much on entertainment, clothing, or cable?

- You can give yourself more income to put to baby step 1 almost instantly, just by cutting your expenses.

- Be honest with yourself on what is necessary, and what is keeping you from reaching your financial goals.

Related: How to Drastically Reduce Your Monthly Expenses.

Get cash for clothes, bags, and jewelry on Poshmark.

- Selling on Poshmark has been one of my favorite side hustles!

- The amount of clothing, shoes, jewelry, and designer bags that simply collect dust in our closets is crazy!

- People will buy your used clothing, for a much higher profit than selling at a consignment store.

- You don’t even need designer items. I sell quite a bit of kid’s clothing, and inexpensive brands like Old Navy or Target.

- Poshmark now allows you to sell home decor on their app as well.

- Sign up for a Poshmark account here, and get $5.

Related: How to Make Money Selling on Poshmark

Sell anything on Mercari.

- Similar to Poshmark, but you can sell pretty much anything!

- I sold a baby monitor on Mercariin about one day.

- The shipping process was simple, and I got paid as soon as the buyer received the item.

- There are listings from handmade items to clothing, and more!

Sell Your Car.

- Okay, this might sound crazy I know!

- Most people are driving a car with a huge car payment.

- The car is going down in value, while you are throwing cash at it every month instead of using it to save or pay off debt.

- We got rid of our lease and second car and bought two cash cars.

- Having two paid for cars helped us increase our cash flow fast.

Start a Side Hustle.

- There are several different ways to make money fast with a profitable side hustle.

- Walking dogs, babysitting, and driving for Uber, are all side hustles that pay pretty well!

- The internet has also opened up a whole new realm of side hustle options that you can do from home.

- Take surveys, become a virtual assistant, or start a blog! The options are endless to make extra money.

Related: Side Hustle Ideas

Dave Ramsey’s baby step 1, gives you the confidence you need to continue to (and complete), the baby step 2.

An emergency fund of $1,000 might not be much to you, or it could be the most you’ve ever saved in your life.

Either way, intentionally working to save and set aside this money will prove to you that you can budget and save.

This starter emergency fund will be there if you have unexpected car repairs or small medical emergencies, while you are diligently tackling your debt in baby step 2.

You will be able to cover a small emergency, without reaching for a credit card, maybe for the first time in your life!

Get started on Dave Ramsey’s baby steps, and crush baby step 1 today!

P.S. Grab my FREE budgeting printables, and get weekly debt payoff motivation and frugal living tips!